Election Day: May 6, 2023

If additional bond funds become available through construction cost savings, they will be used to reconfigure and expand the seating and press boxes at the JHS baseball and softball fields.

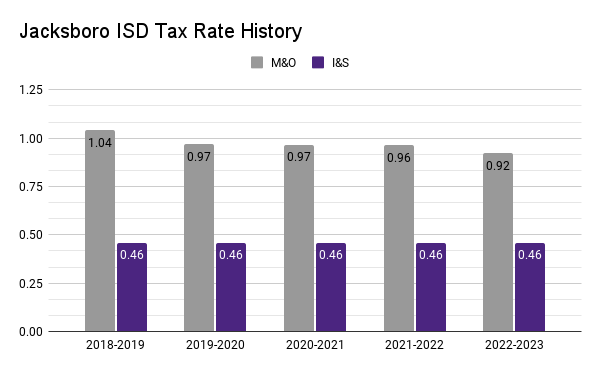

*This rate will actually be lowered again after the bond election in accordance with State law.

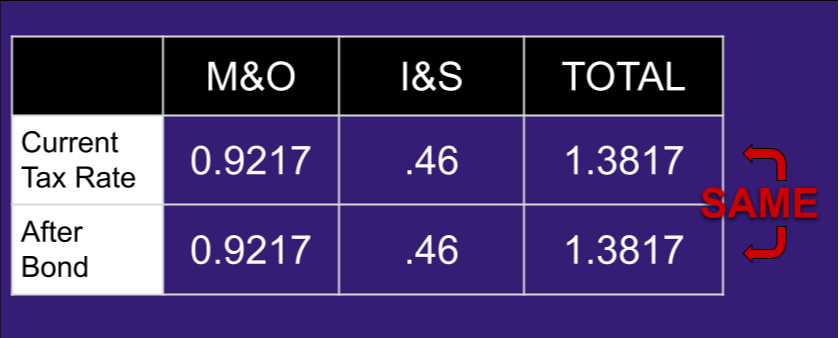

How will this affect my taxes?

The cost will continue to be $69.09 per month on a $100K home. This amount includes the homestead exemption.

Please call (940) 567-6301 for more information about homestead exemptions.

Maintenance & Operation Taxes (M&O)

Used to pay for the day-to-day costs of running the district, including salaries , utilities, supplies, and insurance

Interest and Sinking Taxes (I&S)

Used to pay for the principal and interest on voter-approved bonds for a specific purpose and term. By law, I&S funds cannot be used to pay M&O expenses. Voter approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services. Voter-approved bonds can be used for renovations, repairs and expansions to existing facilities eliminating the pressure on the M&O budget.